YEAROF

ESTABLISHMENT

(SEPT. 1985)

CHANGES (SEPT. 1985~PRESENT)

Assessment Base

•

Covereddeposits

Revised inJanuary2007 to total eligibledeposits.

Insurance

Premium

Flat rate: 0.05%

•

Flat rate,but reduced to0.04% inJuly1987

•

Further reduced to0.015% inJanuary1988

•

Risk-basedpremium systemadoptedonJuly1, 1999, and

three-tier rates instituted: 0.015%, 0.0175%, and0.02%

•

Three-tier rates adjusted to 0.05%, 0.055% and 0.06% on

January1, 2000

•

Revised inJuly2007 to:

Risk-based premium rates for covered deposits within

themaximum coverage and a flat rate for any amounts

beyond this, as follows:

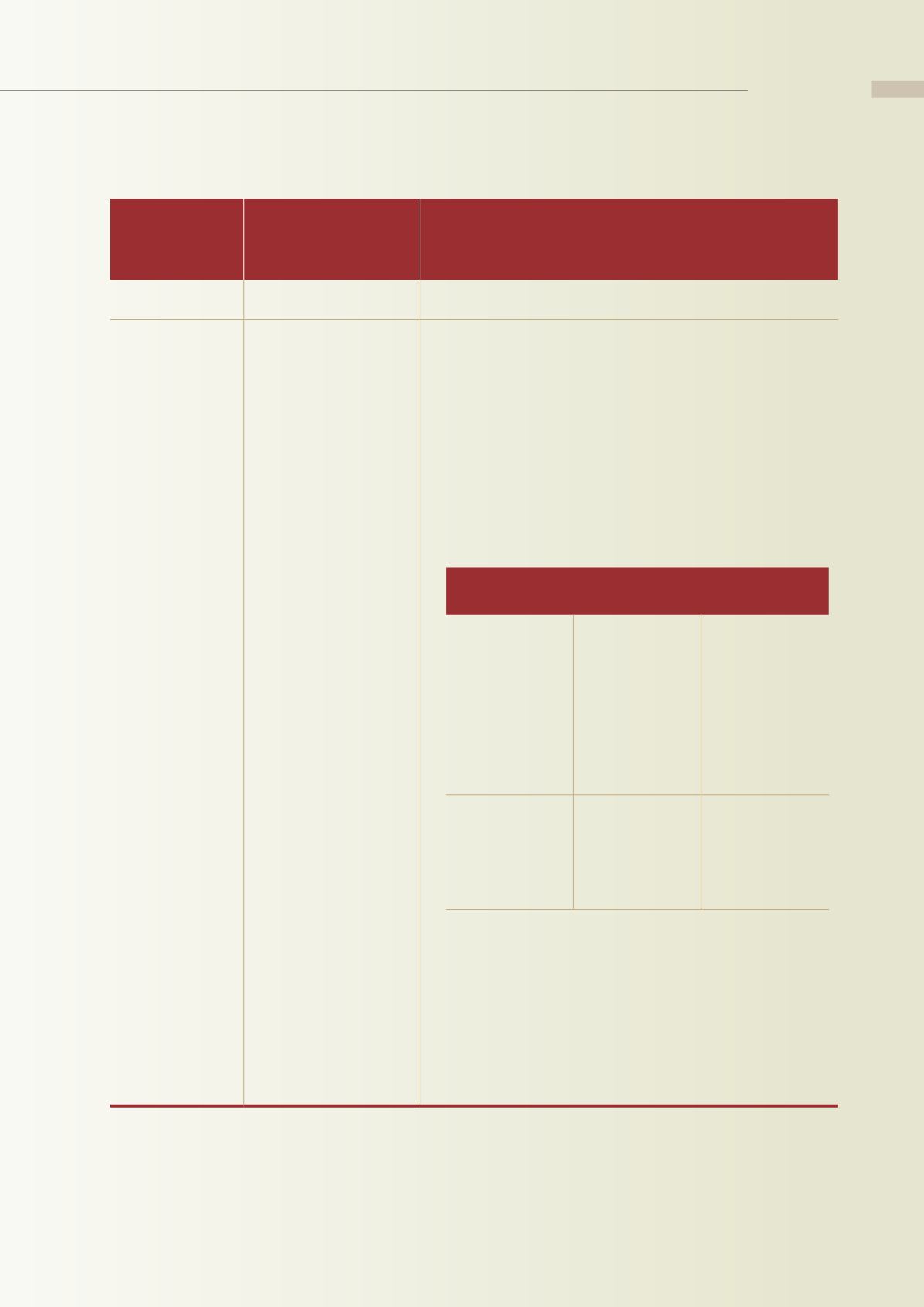

FINANCIAL

INSTITUTIONS

RISK-BASED

PREMIUMRATES

FLATPREMIUM

RATE

Domesticbanks,

foreignbank

branches in

Taiwan, trust

and investment

companies,

and credit

cooperatives

Five-tier rates:

0.03%, 0.04%,

0.05%,0.06%,and

0.07%

Formerly0.0025%,

but fromJanuary

1, 2010 the flat

premium rate

was adjusted to

0.005%

Credit

departments

of farmers’ and

fishermen’s

associations

Five-tier rates:

0.02%, 0.03%,

0.04%,0.05%,and

0.06%

0.0025%

•

Revised inNovember 2010 to:

Risk-based premium rates for eligible deposits within

themaximum coverage and a flat rate for any amounts

beyond this, effective from January 1, 2011; also revised

in October 2013 the term “Local Branches of Foreign

Banks” into “Local Branches of Foreign Banks and

Mainland Chinese Banks” and applied the same risk-

basedpremium rateas follows:

65

Appendix