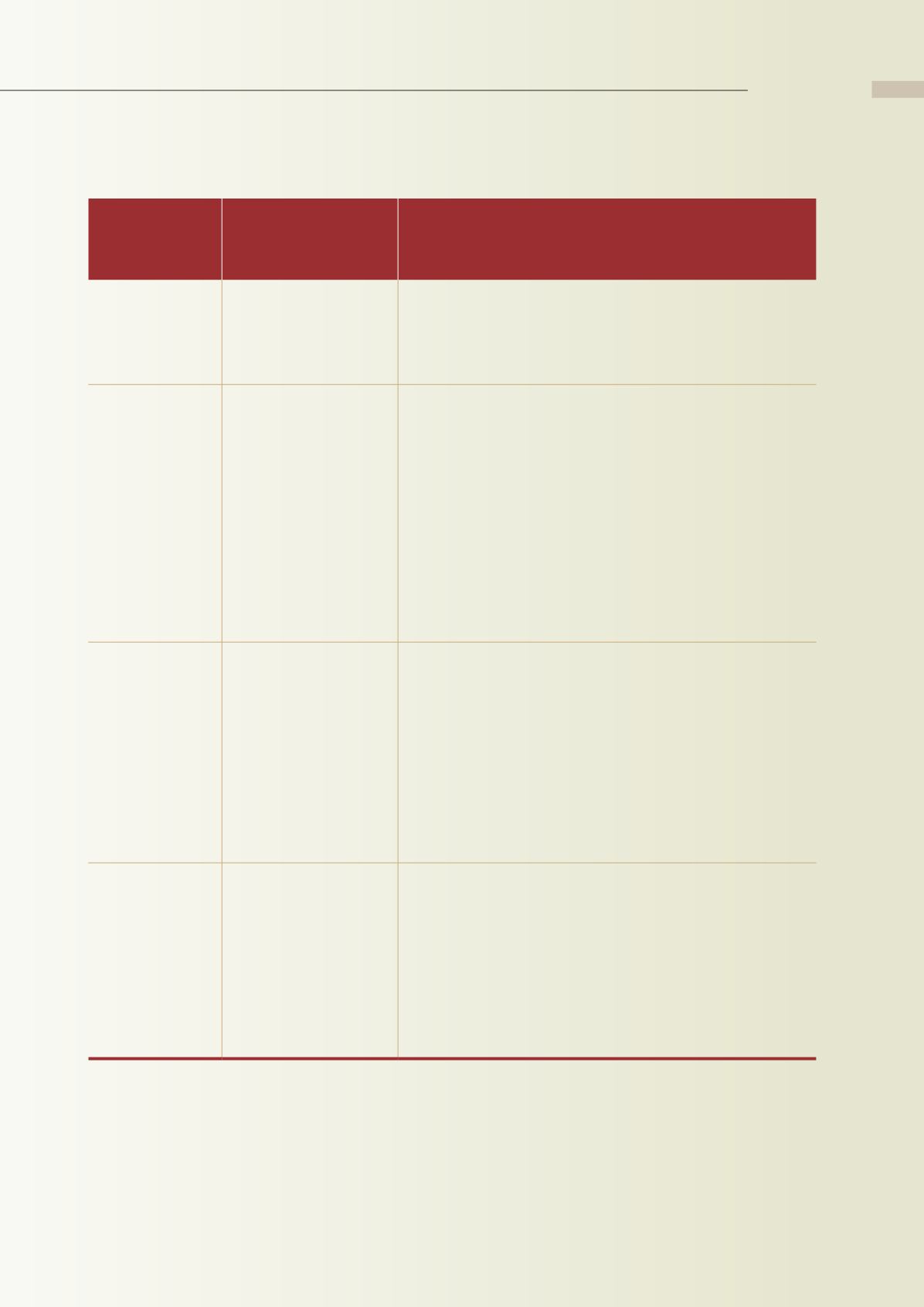

YEAROF

ESTABLISHMENT

(SEPT. 1985)

CHANGES (SEPT. 1985~PRESENT)

Borrowingof

Funds from

Other Financial

Institutions

None

Added inJanuary1999

Provisionof

Collateral when

Applying to the

Central Bank for

Accommodation

Full collateralmust be

provided.

•

Provisions added inJanuary1999as follows:

1.Thatpart forwhichtheCDIC isunabletoprovidecollateral istobe

guaranteedbytheNationalTreasury.

2.When the securedportionexceeds theCDIC’s net worth, the

competent authority and theCentral Bankmust apply to the

ExecutiveYuan forapproval.

•

Revised inJanuary2007 to:

Through a joint request by the competent authority with

theMinistryof Financeand theCentral Bankandapproval

by theExecutiveYuan, thepart forwhich collateral cannot

beprovidedmaybeguaranteedby theNational Treasury.

Penalty for

Refusal toApply

toParticipate in

Deposit Insurance

None

•

Provisionadded inJanuary1999:

A fine of double the amount of the deposit insurance

premium for penalty is tobe imposed.

•

Revised inJanuary2007 to:

Depending on whether the institution is a general

financial institution or agricultural financial institution, the

CDIC shall report to the competent authority toorder the

financial institution to replace its persons in charge or to

revoke itsbusiness license.

Methodof

Allocationof the

CDIC’sSurplus

As stipulated in the

CompanyAct

•

Beginning in July 2001, the entire amount of the surplus

remaining after the accounts are closed is placed into the

Deposit InsurancePayout Special Reserves.

•

Revised inJanuary2007 to:

The entire amount of the surplus remaining from annual

income after deducting costs, expenses and losses shall

be deposited into the Deposit Insurance Payout Special

Reserves.

71

Appendix