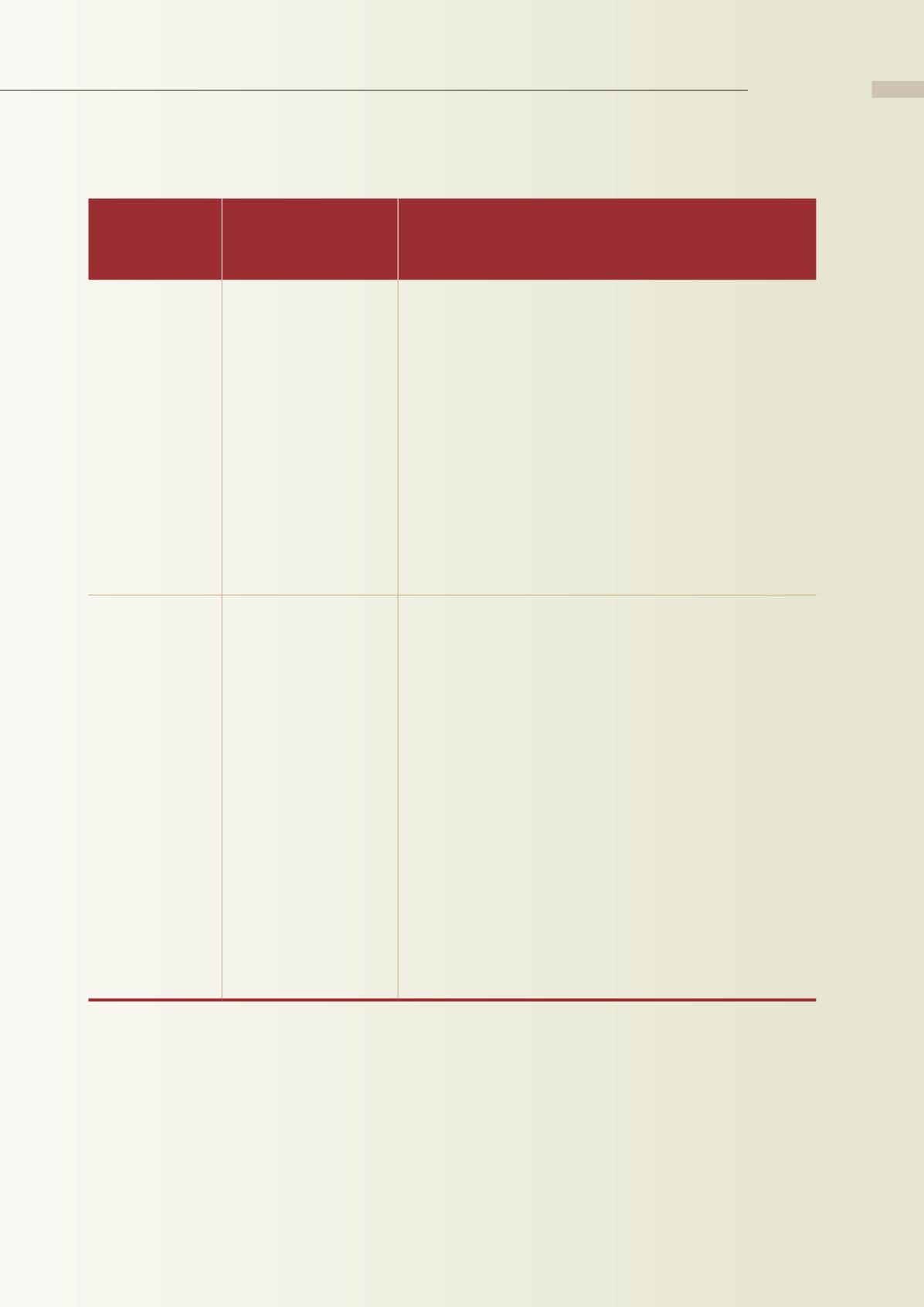

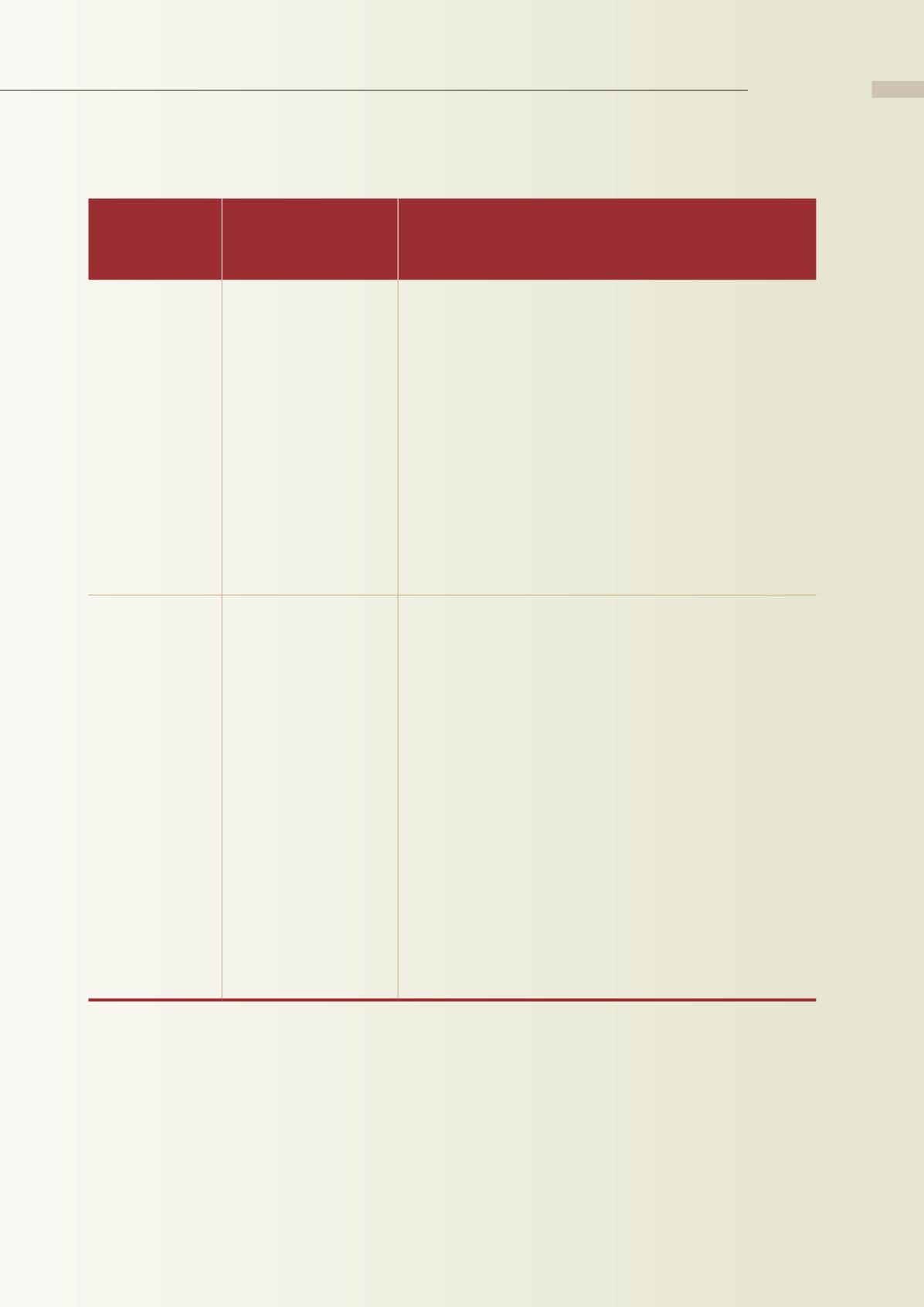

YEAROF

ESTABLISHMENT

(SEPT. 1985)

CHANGES (SEPT. 1985~PRESENT)

ScopeofCoverage Deposit principal and

interest

•

FromJanuary1999, limited todeposit principal.

•

Limited to principal as above. However, beginning

in July 2001, the principal and interest of deposits in

unsound financial institutionsdisposedof by theFinancial

RestructuringFundwerebothguaranteed.

•

In October 2008, the government announced that the

coverage of deposits under the temporary full deposit

insurance coverage would include both principal and

interest untilDecember 31, 2009.

•

On December 29, 2010, amendments toArticles 12 and

13 of the Deposit Insurance Act were promulgated by

Presidential decree, whereby the scope of coverage was

enlarged to include both foreign currency deposits and

interest ondeposits.

Typesof Eligible

Deposits

•

Checkingdeposits

•

Demanddeposits

•

Timedeposits

•

Savingsdeposits

•

Trust funds

•

Other deposits

that the competent

authorityhas

approvedaseligible

•

Same as the left column. (Beginning in July 2001, all

deposits and non-deposit liabilities of insured institutions

disposedof by theFinancial RestructuringFundwere fully

guaranteed. In June2005, after a revisionof the Financial

Restructuring Fund Statute, the non-deposit liabilities

of unsound financial institutions were not eligible for

protection. However, those non-deposit liabilities that

were incurred prior to the implementation of the revised

Statute remainedprotected.)

•

Revised inJanuary2007

:

Deletionof “Trust funds”.

•

Revised inMay2008as follows:

1.Checkingdeposits

2.Demanddeposits

3.Timedeposits

4.Deposits requiredby law tobedeposited in certain financial

institutions

5.Other deposits that the competent authority has approved as

eligible

67

Appendix