Page 27 - CDIC Company Profile Ebook

P. 27

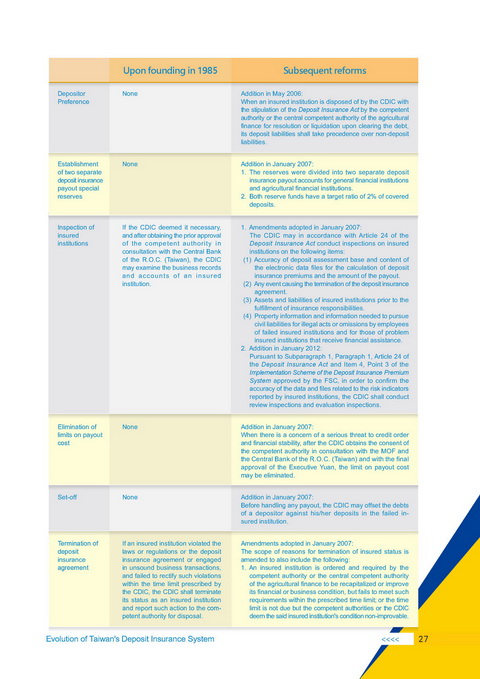

Upon founding in 1985 Subsequent reforms

Depositor None Addition in May 2006:

Preference When an insured institution is disposed of by the CDIC with

the stipulation of the Deposit Insurance Act by the competent

authority or the central competent authority of the agricultural

finance for resolution or liquidation upon clearing the debt,

its deposit liabilities shall take precedence over non-deposit

liabilities.

Establishment None Addition in January 2007:

of two separate 1. The reserves were divided into two separate deposit

deposit insurance insurance payout accounts for general financial institutions

payout special and agricultural financial institutions.

reserves 2. Both reserve funds have a target ratio of 2% of covered

deposits.

Inspection of If the CDIC deemed it necessary, 1. Amendments adopted in January 2007:

insured and after obtaining the prior approval The CDIC may in accordance with Article 24 of the

institutions of the competent authority in Deposit Insurance Act conduct inspections on insured

consultation with the Central Bank institutions on the following items:

of the R.O.C. (Taiwan), the CDIC (1) Accuracy of deposit assessment base and content of

may examine the business records the electronic data files for the calculation of deposit

and accounts of an insured insurance premiums and the amount of the payout.

institution. (2) Any event causing the termination of the deposit insurance

agreement.

(3) Assets and liabilities of insured institutions prior to the

fulfillment of insurance responsibilities.

(4) Property information and information needed to pursue

civil liabilities for illegal acts or omissions by employees

of failed insured institutions and for those of problem

insured institutions that receive financial assistance.

2. Addition in January 2012:

Pursuant to Subparagraph 1, Paragraph 1, Article 24 of

the Deposit Insurance Act and Item 4, Point 3 of the

Implementation Scheme of the Deposit Insurance Premium

System approved by the FSC, in order to confirm the

accuracy of the data and files related to the risk indicators

reported by insured institutions, the CDIC shall conduct

review inspections and evaluation inspections.

Elimination of None Addition in January 2007:

limits on payout When there is a concern of a serious threat to credit order

cost and financial stability, after the CDIC obtains the consent of

the competent authority in consultation with the MOF and

the Central Bank of the R.O.C. (Taiwan) and with the final

approval of the Executive Yuan, the limit on payout cost

may be eliminated.

Set-off None Addition in January 2007:

Before handling any payout, the CDIC may offset the debts

of a depositor against his/her deposits in the failed in-

sured institution.

Termination of If an insured institution violated the Amendments adopted in January 2007:

deposit laws or regulations or the deposit The scope of reasons for termination of insured status is

insurance insurance agreement or engaged amended to also include the following:

agreement in unsound business transactions, 1. An insured institution is ordered and required by the

and failed to rectify such violations competent authority or the central competent authority

within the time limit prescribed by of the agricultural finance to be recapitalized or improve

the CDIC, the CDIC shall terminate its financial or business condition, but fails to meet such

its status as an insured institution requirements within the prescribed time limit; or the time

and report such action to the com- limit is not due but the competent authorities or the CDIC

petent authority for disposal. deem the said insured institution's condition non-improvable.

Evolution of Taiwan's Deposit Insurance System >>>> 27