Page 24 - CDIC Company Profile Ebook

P. 24

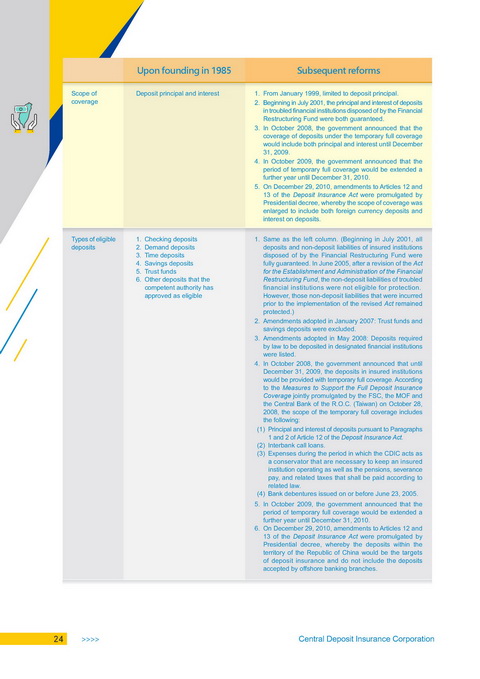

Upon founding in 1985 Subsequent reforms

Scope of Deposit principal and interest 1. From January 1999, limited to deposit principal.

coverage 2. Beginning in July 2001, the principal and interest of deposits

in troubled financial institutions disposed of by the Financial

Restructuring Fund were both guaranteed.

3. In October 2008, the government announced that the

coverage of deposits under the temporary full coverage

would include both principal and interest until December

31, 2009.

4. In October 2009, the government announced that the

period of temporary full coverage would be extended a

further year until December 31, 2010.

5. On December 29, 2010, amendments to Articles 12 and

13 of the Deposit Insurance Act were promulgated by

Presidential decree, whereby the scope of coverage was

enlarged to include both foreign currency deposits and

interest on deposits.

Types of eligible 1. Checking deposits 1. Same as the left column. (Beginning in July 2001, all

deposits 2. Demand deposits deposits and non-deposit liabilities of insured institutions

3. Time deposits disposed of by the Financial Restructuring Fund were

4. Savings deposits fully guaranteed. In June 2005, after a revision of the Act

5. Trust funds for the Establishment and Administration of the Financial

6. Other deposits that the Restructuring Fund, the non-deposit liabilities of troubled

competent authority has financial institutions were not eligible for protection.

approved as eligible However, those non-deposit liabilities that were incurred

prior to the implementation of the revised Act remained

protected.)

2. Amendments adopted in January 2007: Trust funds and

savings deposits were excluded.

3. Amendments adopted in May 2008: Deposits required

by law to be deposited in designated financial institutions

were listed.

4. In October 2008, the government announced that until

December 31, 2009, the deposits in insured institutions

would be provided with temporary full coverage. According

to the Measures to Support the Full Deposit Insurance

Coverage jointly promulgated by the FSC, the MOF and

the Central Bank of the R.O.C. (Taiwan) on October 28,

2008, the scope of the temporary full coverage includes

the following:

(1) Principal and interest of deposits pursuant to Paragraphs

1 and 2 of Article 12 of the Deposit Insurance Act.

(2) Interbank call loans.

(3) Expenses during the period in which the CDIC acts as

a conservator that are necessary to keep an insured

institution operating as well as the pensions, severance

pay, and related taxes that shall be paid according to

related law.

(4) Bank debentures issued on or before June 23, 2005.

5. In October 2009, the government announced that the

period of temporary full coverage would be extended a

further year until December 31, 2010.

6. On December 29, 2010, amendments to Articles 12 and

13 of the Deposit Insurance Act were promulgated by

Presidential decree, whereby the deposits within the

territory of the Republic of China would be the targets

of deposit insurance and do not include the deposits

accepted by offshore banking branches.

24 <<<< Central Deposit Insurance Corporation