Page 23 - CDIC Company Profile Ebook

P. 23

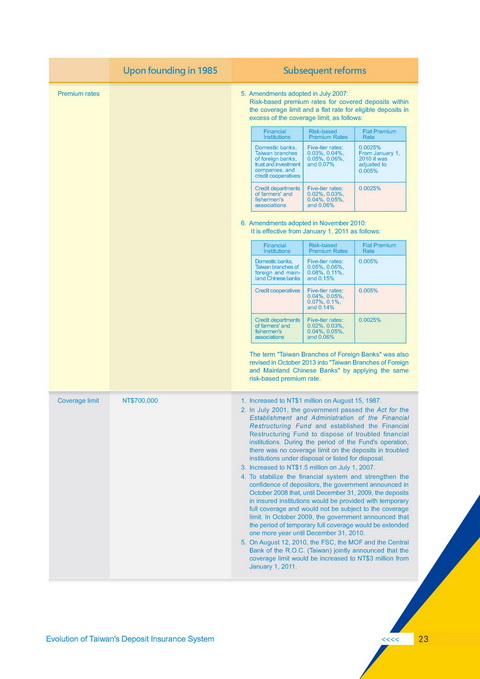

Upon founding in 1985 Subsequent reforms

Premium rates 5. Amendments adopted in July 2007:

Risk-based premium rates for covered deposits within

the coverage limit and a flat rate for eligible deposits in

excess of the coverage limit, as follows:

Financial Risk-based Flat Premium

Institutions Premium Rates Rate

Domestic banks, Five-tier rates: 0.0025%

Taiwan branches 0.03%, 0.04%, From January 1,

of foreign banks, 0.05%, 0.06%, 2010 it was

trust and investment and 0.07% adjusted to

companies, and 0.005%

credit cooperatives

Credit departments Five-tier rates: 0.0025%

of farmers' and 0.02%, 0.03%,

fishermen's 0.04%, 0.05%,

associations and 0.06%

6. Amendments adopted in November 2010:

It is effective from January 1, 2011 as follows:

Financial Risk-based Flat Premium

Institutions Premium Rates Rate

Domestic banks, Five-tier rates: 0.005%

Taiwan branches of 0.05%, 0.06%,

foreign and main- 0.08%, 0.11%,

land Chinese banks and 0.15%

Credit cooperatives Five-tier rates: 0.005%

0.04%, 0.05%,

0.07%, 0.1%,

and 0.14%

Credit departments Five-tier rates: 0.0025%

of farmers' and 0.02%, 0.03%,

fishermen's 0.04%, 0.05%,

associations and 0.06%

The term "Taiwan Branches of Foreign Banks" was also

revised in October 2013 into "Taiwan Branches of Foreign

and Mainland Chinese Banks" by applying the same

risk-based premium rate.

Coverage limit NT$700,000 1. Increased to NT$1 million on August 15, 1987.

2. In July 2001, the government passed the Act for the

Establishment and Administration of the Financial

Restructuring Fund and established the Financial

Restructuring Fund to dispose of troubled financial

institutions. During the period of the Fund's operation,

there was no coverage limit on the deposits in troubled

institutions under disposal or listed for disposal.

3. Increased to NT$1.5 million on July 1, 2007.

4. To stabilize the financial system and strengthen the

confidence of depositors, the government announced in

October 2008 that, until December 31, 2009, the deposits

in insured institutions would be provided with temporary

full coverage and would not be subject to the coverage

limit. In October 2009, the government announced that

the period of temporary full coverage would be extended

one more year until December 31, 2010.

5. On August 12, 2010, the FSC, the MOF and the Central

Bank of the R.O.C. (Taiwan) jointly announced that the

coverage limit would be increased to NT$3 million from

January 1, 2011.

Evolution of Taiwan's Deposit Insurance System >>>> 23