Page 22 - CDIC Company Profile Ebook

P. 22

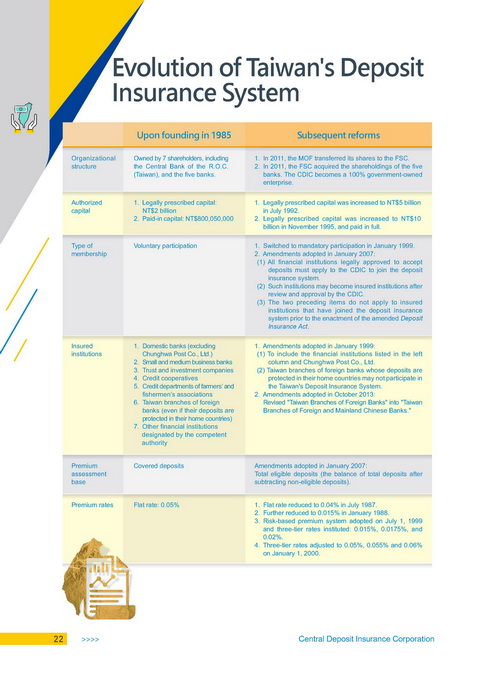

Evolution of Taiwan's Deposit

Insurance System

Upon founding in 1985 Subsequent reforms

Organizational Owned by 7 shareholders, including 1. In 2011, the MOF transferred its shares to the FSC.

structure the Central Bank of the R.O.C. 2. In 2011, the FSC acquired the shareholdings of the five

(Taiwan), and the five banks. banks. The CDIC becomes a 100% government-owned

enterprise.

Authorized 1. Legally prescribed capital: 1. Legally prescribed capital was increased to NT$5 billion

capital NT$2 billion in July 1992.

2. Paid-in capital: NT$800,050,000 2. Legally prescribed capital was increased to NT$10

billion in November 1995, and paid in full.

Type of Voluntary participation 1. Switched to mandatory participation in January 1999.

membership 2. Amendments adopted in January 2007:

(1) All financial institutions legally approved to accept

deposits must apply to the CDIC to join the deposit

insurance system.

(2) Such institutions may become insured institutions after

review and approval by the CDIC.

(3) The two preceding items do not apply to insured

institutions that have joined the deposit insurance

system prior to the enactment of the amended Deposit

Insurance Act.

Insured 1. Domestic banks (excluding 1. Amendments adopted in January 1999:

institutions Chunghwa Post Co., Ltd.) (1) To include the financial institutions listed in the left

2. Small and medium business banks column and Chunghwa Post Co., Ltd.

3. Trust and investment companies (2) Taiwan branches of foreign banks whose deposits are

4. Credit cooperatives protected in their home countries may not participate in

5. Credit departments of farmers’ and the Taiwan's Deposit Insurance System.

fishermen’s associations 2. Amendments adopted in October 2013:

6. Taiwan branches of foreign Revised "Taiwan Branches of Foreign Banks" into "Taiwan

banks (even if their deposits are Branches of Foreign and Mainland Chinese Banks."

protected in their home countries)

7. Other financial institutions

designated by the competent

authority

Premium Covered deposits Amendments adopted in January 2007:

assessment Total eligible deposits (the balance of total deposits after

base subtracting non-eligible deposits).

Premium rates Flat rate: 0.05% 1. Flat rate reduced to 0.04% in July 1987.

2. Further reduced to 0.015% in January 1988.

3. Risk-based premium system adopted on July 1, 1999

and three-tier rates instituted: 0.015%, 0.0175%, and

0.02%.

4. Three-tier rates adjusted to 0.05%, 0.055% and 0.06%

on January 1, 2000.

22 <<<< Central Deposit Insurance Corporation