Page 26 - CDIC Company Profile Ebook

P. 26

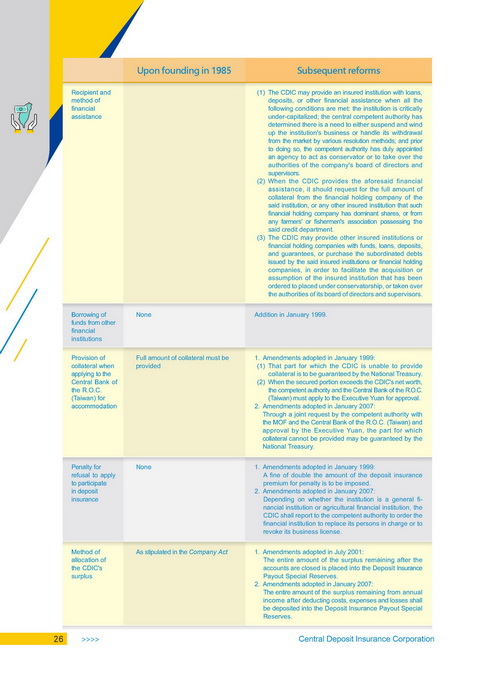

Upon founding in 1985 Subsequent reforms

Recipient and (1) The CDIC may provide an insured institution with loans,

method of deposits, or other financial assistance when all the

financial following conditions are met: the institution is critically

assistance under-capitalized; the central competent authority has

determined there is a need to either suspend and wind

up the institution's business or handle its withdrawal

from the market by various resolution methods; and prior

to doing so, the competent authority has duly appointed

an agency to act as conservator or to take over the

authorities of the company's board of directors and

supervisors.

(2) When the CDIC provides the aforesaid financial

assistance, it should request for the full amount of

collateral from the financial holding company of the

said institution, or any other insured institution that such

financial holding company has dominant shares, or from

any farmers' or fishermen's association possessing the

said credit department.

(3) The CDIC may provide other insured institutions or

financial holding companies with funds, loans, deposits,

and guarantees, or purchase the subordinated debts

issued by the said insured institutions or financial holding

companies, in order to facilitate the acquisition or

assumption of the insured institution that has been

ordered to placed under conservatorship, or taken over

the authorities of its board of directors and supervisors.

Borrowing of None Addition in January 1999.

funds from other

financial

institutions

Provision of Full amount of collateral must be 1. Amendments adopted in January 1999:

collateral when provided (1) That part for which the CDIC is unable to provide

applying to the collateral is to be guaranteed by the National Treasury.

Central Bank of (2) When the secured portion exceeds the CDIC's net worth,

the R.O.C. the competent authority and the Central Bank of the R.O.C.

(Taiwan) for (Taiwan) must apply to the Executive Yuan for approval.

accommodation 2. Amendments adopted in January 2007:

Through a joint request by the competent authority with

the MOF and the Central Bank of the R.O.C. (Taiwan) and

approval by the Executive Yuan, the part for which

collateral cannot be provided may be guaranteed by the

National Treasury.

Penalty for None 1. Amendments adopted in January 1999:

refusal to apply A fine of double the amount of the deposit insurance

to participate premium for penalty is to be imposed.

in deposit 2. Amendments adopted in January 2007:

insurance Depending on whether the institution is a general fi-

nancial institution or agricultural financial institution, the

CDIC shall report to the competent authority to order the

financial institution to replace its persons in charge or to

revoke its business license.

Method of As stipulated in the Company Act 1. Amendments adopted in July 2001:

allocation of The entire amount of the surplus remaining after the

the CDIC's accounts are closed is placed into the Deposit Insurance

surplus Payout Special Reserves.

2. Amendments adopted in January 2007:

The entire amount of the surplus remaining from annual

income after deducting costs, expenses and losses shall

be deposited into the Deposit Insurance Payout Special

Reserves.

26 <<<< Central Deposit Insurance Corporation